Financial Access is a long established financial sector advisory firm with a global 25 year track record of implementing change and capacity development for – and with – financial institutions in emerging markets. In November 2015, Financial Access incorporated a finance company called Financial Access Commerce & Trade Services (“FACTS”) with operations in Kenya, Uganda and a Head Office in the Netherlands.

Today, FACTS lends to SMEs in Kenya, Uganda and (soon) Tanzania. The ideas and concepts behind our business model go back to the successful Finance for Agriculture (“F4A”) programmes that we ran in Kenya and Uganda between 2013 and 2017 in cooperation with the Embassy of the Netherlands.

Filters:

Peter van der Krogt is the Chairman of Financial Access Capital Management B.V. and co-founder of Financial Access. He is focused on the firm’s Banking Advisory and SME Finance activities, particularly in East Africa. He has over 40 years of experience working with private and public financial institutions, including the Dutch Ministry of Finance and the World Bank/IFC in Washington, DC. In 1989 he joined ING Bank and worked mostly in Emerging Markets. During his career within ING Bank he held senior management positions in wholesale banking in the Philippines and Russia, responsible for corporate banking and structured & project finance.

From 1999 until 2002 he led the restructuring and repositioning of Lippo Bank as Project Manager, one of the largest private banks in Indonesia, into a modern Retail and SME bank. For several years he was the Global Head of ING’s Financial Institutions advisory business, the company that became Financial Access. He has supervised many advisory projects and has been actively involved as principal adviser in strategic planning, business development and governance. He has implemented and rolled-out new products and banking concepts in many banks in Africa e.g in Angola, Burundi, Kenya, Mauritania, Nigeria, Tanzania and Uganda.

Mr. van der Krogt holds a MA from the University of Leiden and is fluent in Dutch and English.

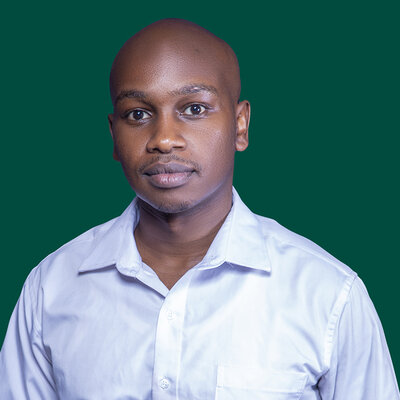

Peter Ndirangu has a rich experience in Finance and Banking Sectors. He also has extensive knowledge in accounting and is a certified public accountant of Kenya [CPA (K)]. He holds a Master’s in Business Administration from Strathmore Business School, a BSc. in International Business Administration from the United States International University – Africa, an Executive certificate in Agriculture Finance and extensive knowledge in Certification of Information Systems Audit.

He has worked as an Internal Auditor at Saam Kenya Limited (Fabric City at Nakumatt Holdings), a Finance Officer at Financial Access East Africa Limited and a Finance Manager at Financial Access Commerce & Trade Services (K) Limited.

He is currently the Head of Finance and Admin Regional office (East Africa) based in Nairobi, Kenya where he maintains Financials, Planning and Admin obligations for the Financial Access group. He also supports the Head Office in Amsterdam, Netherlands on Financial Consolidated Reporting.

He is passionate about Corporate Finance and Economics Fields, Institutional Governance and Administration and Critical Thinking on a basis of creativity and innovation to add Value.

LinkedIn: https://www.linkedin.com/in/peter-ndirangu-7760aa48

Ms. Sembiro Isabel Diana is a former Banker with a wealth of experience spanning over 10 years in the Banking industry mostly concentrated in credit risk management and administration.

Prior to joining FACTS (U) LTD, she served as a credit analyst with Orient Bank, a Senior Credit Risk Officer at Diamond Trust Bank and also worked in various roles with Guaranty Trust Bank (formerly FINA Bank) where she spent the bulk of her banking career.

She Holds a Bachelor’s Degree in Commerce from Makerere University, Certificates in Basic Banking, Credit management and Lending to SME’s from the Uganda Institute of Banking and Financial Services.

LinkedIn: https://www.linkedin.com/in/isabel-sembiro-208a5564

Jessica Bernah Nalubega is the Business development Manager FACTS Uganda. Before joining FACTS, she served as a distribution manager in Parambot Breweries Limited before rising to acting sales and marketing manager.

She has ten years banking experience. She started her banking career in Standard Bank as a teller and later became a customer service consultant. She also served in the business banking department where she worked as a business relationship officer before assuming the role of Relationship Manager SME.

She holds a Diploma in Business Studies from Makerere University and a Bachelor’s degree in Business Administration from Nkumba University.

LinkedIn: https://www.linkedin.com/in/jessica-nalubega-ba0a98112

Mr. Munyae specializes in Infrastructure and General IT Support and Management as well as Systems Project Management and Processes Quality Assurance. Prior to joining FACTS Africa, he worked with different organizations in various capacities, most recently as an IT Administrator.

He has a Degree in Information Technology from Jomo Kenyatta University of Agriculture and Technology, he is certified in Cisco Certified Network Associate (CCNA), ITIL v3 certified, Microsoft Certified Solutions Associate (MCSA) and has a foundation certification in International Factoring (FCI).

Blessing Nakalema has over 10 years of experience in the Trade and Supply Chain Finance, Transactional Products Services, Revenue Assurance and operations, having served under various capacities.

She was part of the team at Stanbic Bank Head Office that launched the Finacle system under the Learning and Development Unit (which involved creating awareness among the bank staff on the new core banking system that eventually had a successful roll out). Blessing has also served in other nations like South Africa, Tanzania, and Kenya where she lended her skills as Trade Finance Officer for 6 months.

Blessing holds a Masters in Business Administration (Finance) (MBA)at Makerere University Kampala as well as a Bachelor’s degree in Social Work and Social Administration (BSWSA) at Makerere University Kampala.

She also holds a certificate in FCI Factoring Foundation Course

LinkedIn: https://www.linkedin.com/in/aisha-blessing-nakalema-56842b9b

Eric joined FACTS in July 2016. Prior to joining FACTS, he worked in various capacities in both the banking and insurance sectors and has experience in financial and risk management, compliance, credit risk analysis and financial data analysis. He is responsible for appraising financing requests and monitoring performance of the credit facilities.

Eric holds a degree in Actuarial Science from Dedan Kimathi University of Technology and a Bachelor of Commerce (Finance) degree from Jomo Kenyatta University. In addition, he has CPA 2 and recently obtained his Masters of Science degree in Finance and Investments from the University of Nairobi in 2021.

LinkedIn: https://www.linkedin.com/in/eric-macharia-2bb32046

Desire Kakyo has over 9 years working experience in operations and customer service.

She has worked as an Evaluations Assistant with Catholic Relief Services and PSFU as well as with Guaranty Trust Bank U Ltd where she worked as a Teller, Customer Care Service Officer and Branch Operations Supervisor.

Desire has a Bachelor’s degree in Business Administration (Finance Option) from Makerere University and is currently pursuing her MBA – Project Management option.

Hellen is an organized and adaptable administrative assistant with five years’ experience working in various office environments. She has leveraged strong multitasking skills to manage customer service, data entry, inventory control and purchasing of supplies. Additionally, Hellen facilitates event registration, maintains customer files, updates mailing lists and supports other departments and cross-functional teams in addressing customer needs with much emphasis on ensuring that every task is completed efficiently and to the highest possible standard.

She holds a Diploma in Procurement and Logistics Management.

LinkedIn: https://www.linkedin.com/in/nahone-hellen-24bb1aa9

Jan Cherim is a Managing Director for the Small Enterprise Assistance Funds (SEAF), a pioneering emerging markets Private Equity firm with an SME focus and investment teams in some 15 countries worldwide. He manages their hub in the EU (based in Amsterdam) and coordinates advisory services, European investor relations and business development and serves as Director of various SEAF funds globally. Mr. Cherim’s earlier investment experience includes establishing asset management companies in Thailand (mutual funds), Poland and China (PE) for ING, as well as launching the bank’s first Emerging Markets debt fund.

On behalf of SEAF, Mr Cherim is a non-Executive Chair of the FACTS holding company and was a co-founder of Financial Access Capital Partners. He has over 30 years of banking, investment management and consulting experience in Europe, the Far East, Africa and the Caribbean. He has advised corporate, financial sector and sovereign clients in the areas of financing, investment, strategic development, management organisation, balance sheet restructuring, privatisation, as well as risk management, governance and internal audit concerns. He led the SEAF-backed MBO of Financial Access from ING Bank in 2007, a business he had helped to launch in the early 1990s. He is actively involved with clients in the PE, financial and SME/agri-financing sectors. He is a recognised authority in performance enhancement in banking.

At ING, Mr Cherim was a member of the Management Committee of ING Bank’s Wholesale International (Banking) unit based in Amsterdam, and Head of ING’s Financial Institutions business, with global responsibility for FIG products and relationship managers, including the lending, payments, securities services, trade finance, and the advisory practice for financial sector clients (which became FA). He was Country Manager for ING in Thailand, as well as Regional Director for Africa.

Before joining ING in 1990, he worked in international corporate finance at S.G. Warburg & Co. in London (now UBS Investment Banking), and in research at the World Bank in Washington. Mr Cherim was educated at The Johns Hopkins University (USA) and the London School of Economics (UK).

LinkedIn: httpsss://www.linkedin.com/in/jancherim

Mark is a full-stack developer contributing to product engineering and streamlining workflows.

He is a certified software developer from the Moringa School core program.

Linkedin – https://www.linkedin.com/in/mark-watitwa-94b91a154/